What Is Financial Liquidity?

These assets play a crucial role in the financial markets by providing companies with quick access to funds in case of emergencies or to capitalize on sudden investment opportunities. Maintaining optimal levels of cash and cash equivalents is essential for businesses to ensure they can meet their short-term obligations and seize growth prospects. A well-managed liquidity what does order of liquidity mean position can enhance an entity’s creditworthiness and overall financial stability, making it an integral aspect of effective financial management. By prioritizing assets based on their liquidity, from cash to marketable securities and accounts receivable, financial decision-makers can better navigate uncertain economic conditions and unforeseen expenses.

Advantages of financial liquidity

On a personal finance level, you’ll need liquid assets to cover regular expenses or to fund a non-financed down payment on an asset such as a house or car. And, some real estate transactions, such as buying into a co-op or condo building, require a certain amount of liquid assets to prove you have the funds to pay the maintenance or homeowner association fees. For businesses, liquidity is a critical component of corporate risk assessment and indicates to investors how much cash is on hand to cover short-term debt and other obligations.

How does the order of liquidity impact investment decisions?

- It is a list of a company’s assets showing how quickly they can convert those assets to cash.

- And, some real estate transactions, such as buying into a co-op or condo building, require a certain amount of liquid assets to prove you have the funds to pay the maintenance or homeowner association fees.

- In addition to trading volume, other factors such as the width of bid-ask spreads, market depth, and order book data can provide further insight into the liquidity of a stock.

- Sometimes inventory can be sold quickly, so its position may vary from organization to organization.

- For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it.

This ranking also plays a vital role in risk management strategies by ensuring that sufficient liquid assets are readily available to cover liabilities. Maintaining a healthy liquidity position is essential for financial stability, as it can protect against disruptions in cash flow, market downturns, and sudden changes in funding availability. Having a variety of assets with different levels of liquidity can determine how quickly a company can access funds in times of need. For instance, assets like cash and short-term investments are highly liquid and easily convertible to cash, providing a strong buffer against unexpected financial requirements.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

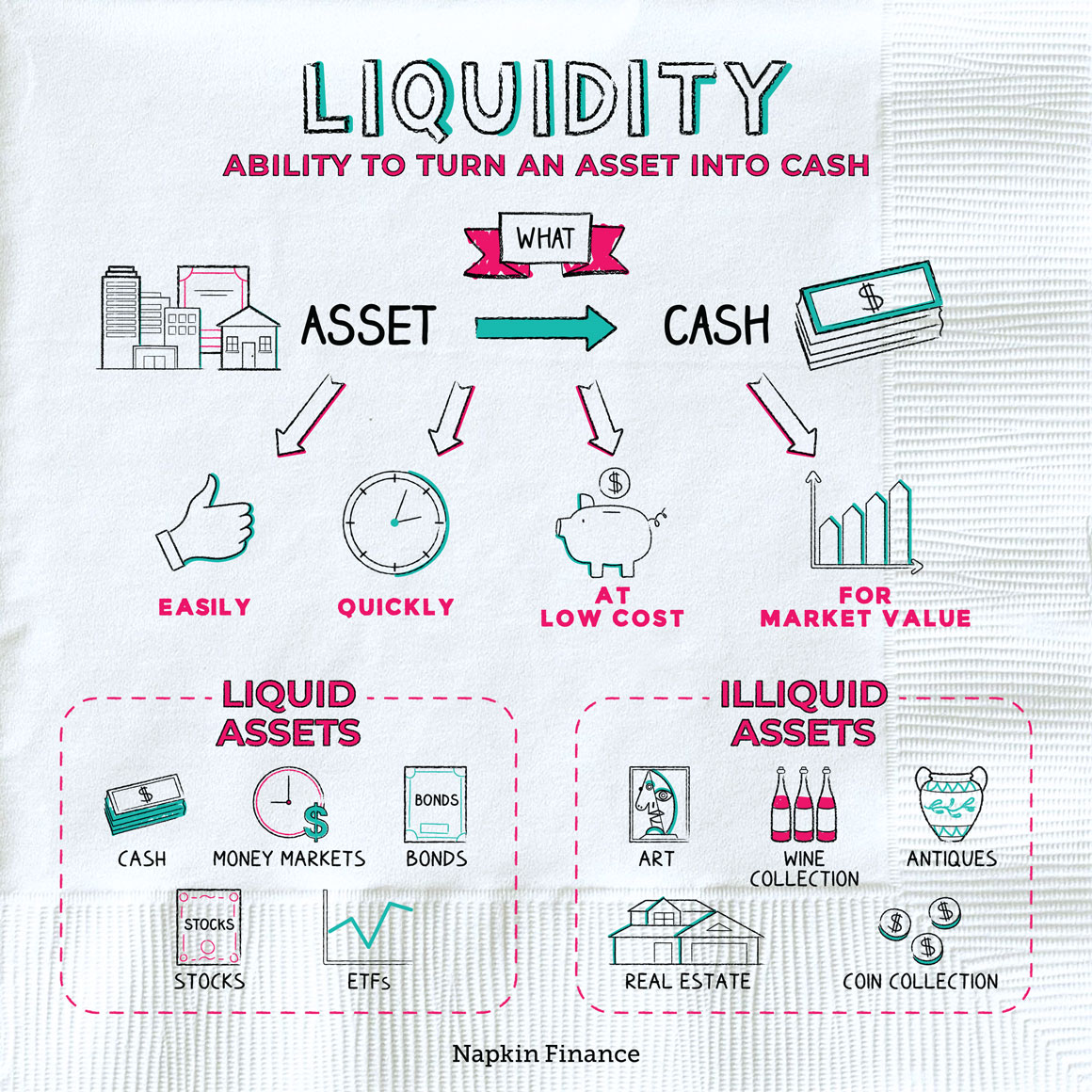

So, while volume is an important factor to consider when evaluating liquidity, it should not be relied upon exclusively. Liquidity considerations play a crucial role in determining how quickly an investment can be converted into cash without significantly impacting its value. Fixed assets are long-term assets such as property, plant, and equipment that are vital for business operations but have lower liquidity compared to current assets. Inventory refers to goods held for sale or production, and while they are essential for operations, their liquidity can be lower compared to assets like cash or marketable securities. Cash and cash equivalents are the most liquid assets, representing funds that are readily available for immediate use without any conversion process. Order of liquidity in finance refers to the ranking of assets based on how quickly they can be converted into cash without significantly affecting their value.

The order of liquidity concept is not used for the revenues or expenses in the income statement, since the liquidity concept does not apply to them. These names tend to be lesser known, have lower trading volume, and often have lower market value and volatility. Investors usually prefer to hold a mix of highly liquid and less liquid assets to balance risk and return.

Do you own a business?

While order of liquidity is a valuable metric, it has limitations, such as overlooking asset quality differences, ignoring market dynamics, and providing a static view of liquidity positions. Learn all about the order of liquidity in finance and understand its significance in managing financial assets. It is a list of a company’s assets showing how quickly they can convert those assets to cash. The order of liquidity is the most important type of liquidity because it determines how a company will pay its bills if it doesn’t have enough cash on hand.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Current assets are usually listed in the order of their liquidity and frequently consist of cash, temporary investments, accounts receivable, inventories and prepaid expenses. On the equity side of the balance sheet, as on the asset side, you need to make a distinction between current and long-term items. Your current liabilities are obligations that you will discharge within the normal operating cycle of your business. In most circumstances your current liabilities will be paid within the next year by using the assets you classified as current. The lack of liquidity in fixed assets can present challenges for businesses, as it limits their ability to quickly convert these assets into cash if needed. This can become a significant concern when making capital allocation decisions, as tying up too much capital in illiquid assets may hinder flexibility and cash flow management.

Without considering the quality of assets or how market conditions may impact liquidity, organizations may have a false sense of security. The order of liquidity directly impacts a company’s financial health by influencing its ability to manage liquidity needs, withstand market shocks, and maintain operational stability. Financial institutions also rely on liquidity to meet their short-term obligations and manage liquidity risk. Adequate liquidity ensures that institutions can honor deposit withdrawals, fulfill payment obligations, and navigate fluctuations in funding conditions. Central banks and regulatory authorities closely monitor liquidity conditions to safeguard the stability of the financial system and prevent disruptions that could have systemic implications. The order of liquidity is the order in which assets are listed on a balance sheet, starting with the most liquid assets and ending with the least liquid assets.