QuickBooks® Online Pricing & Free Trial Official Site

Accept credit cards and payments anywhere and we’ll automatically calculate sales tax for you. Its two-way, real-time sync with every QuickBooks version tackles the jobs humans can do, but don’t want to. Note that if you’re looking for ERP (enterprise resource planning) software, QuickBooks Enterprise is an effective alternative with the right apps. Combining QuickBooks with robust tools like Method gives you the functionality of an ERP like Oracle Netsuite without the hefty price tag.

Advanced

QuickBooks is a well-established accounting software that is widely used by businesses from a variety of industries. With five plans, each at different price points, users can choose the plan that best meets their business needs without paying for additional features that they don’t want. As a business grows, users can easily upgrade to a more advanced plan with additional features seamlessly. QuickBooks is the platform most used by professional accountants so if you plan to work with an accountant, they will likely be very familiar with the platform, its features and capabilities. Terms, conditions, pricing, special features, and service and support options subject to change without notice. QuickBooks Online offers a 30-day free trial of three of its plans, a test drive account of QuickBooks Plus, and a demo of its Advanced plan.

We took all of this user feedback into account when giving QuickBooks Online a user review rating of 4.2/5. While your QuickBooks Online plan includes most of the features you’d expect from accounting software, there are a few additional add-ons available. QuickBooks Payroll is one of the most popular, with prices ranging from $50/month + $6/employee – $130/month + $11/employee. QuickBooks has been phasing out its desktop product offerings and encouraging businesses to move to using one of its online products. After Sept. 30, 2024, QuickBooks Desktop plans will no longer be offered to new customers (although support and updates will continue for existing customers). QuickBooks Enterprise, then, will be the only remaining desktop solution.

Does QuickBooks offer migration support?

QuickBooks Online Advanced costs $235/month and supports up to 25 users. The QuickBooks Online Essentials plan costs $65/month and includes three users and more features. QuickBooks Online is a cloud-based accounting platform while QuickBooks is a desktop program that provides additional inventory management features.

- Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

- QuickBooks Online offers a 30-day free trial of three of its plans, a test drive account of QuickBooks Plus, and a demo of its Advanced plan.

- FreshBooks is great for self-employed individuals, sole proprietors and independent contractors.

- Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

- We believe everyone should be able to make financial decisions with confidence.

Streamline your business with Method

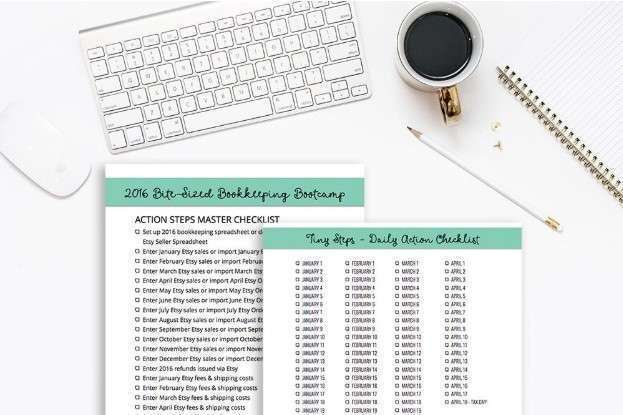

We believe everyone should be able to make financial decisions with confidence. Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses. Depending on which product you choose, you will have to make weekly payments plus APR or other fees. Here’s a complete breakdown of what’s included with each QuickBooks Online pricing plan. If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work.

While cost is an important consideration, it shouldn’t be the only deciding factor when evaluating your accounting software options. Each version has its pros and cons, so factor in ease of use and key features before making a final decision. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews.

QuickBooks Online Advanced Plan

No credit card information or contracts are required, and you can cancel the service at any time. Note, each QuickBooks Live offering requires an active QuickBooks Online subscription and additional terms, conditions, limitations and fees apply. For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service. axa insurance dac definition Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

QuickBooks Online outperforms FreshBooks in many other areas, including advanced features and reporting. QuickBooks has a robust set of features when compared to its competitors, which is why we’ve given it a perfect 5-star rating in this category. Intuit is constantly offering discounts for QuickBooks Online, so be sure to check for any current promotions. Businesses with simple accounting needs and a smaller budget for software. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity.