So when it comes to the latest taxation ramifications, unsecured loans aren’t addressed the same as money

A personal bank loan can feel including money when you find yourself by using the currency to get to know monetary need, such as for example to invest in replacement for windows for your house otherwise another type of sign to suit your automobile. In the place of money, not, you have to pay off the cash – with interest. Some tips about what you may anticipate been taxation big date.

Trick wisdom

- Signature loans aren’t taxable as they are not noticed earnings.

- Should your lender forgives the loan otherwise area of the mortgage, you might have to shell out taxation to your terminated section of your debt.

- It is advisable to speak with an income tax top-notch which have inquiries about reporting earnings plus tax liability.

What exactly is taxable money?

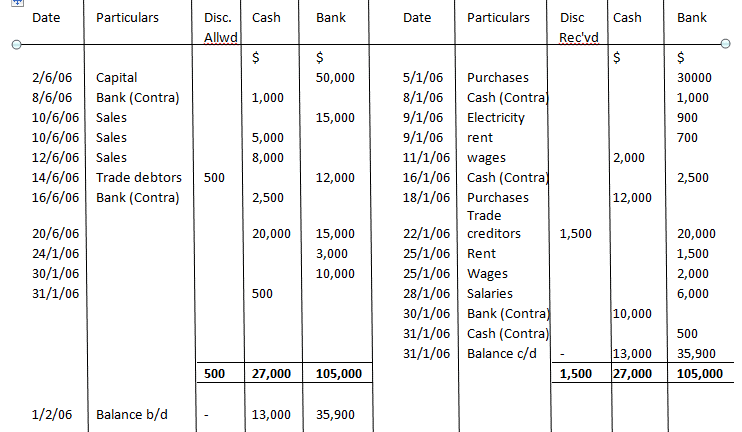

Taxable income is the percentage of another person’s gross income that is subject to fees. It will be the quantity of your income the newest Irs uses so you’re able to assess how much cash tax you borrowed toward federal government each year, plus it boasts both gained and unearned money.

Generated earnings is the currency you have made of performs, including the currency your employer will pay your. Unearned money try currency you will get regarding present apart from an manager. This could include impairment repayments, unemployment experts and investment progress.

Is an unsecured loan money?

Typically, unsecured loans commonly noticed a variety of income. A personal loan was a personal debt, otherwise accountability, perhaps not money – it is therefore not taxable.

A difference towards code

An unsecured loan will get money when your financial cancels, otherwise forgives, the debt. Such as, state your use $step one,000 off a lender and you will pledge to repay they, nevertheless dont. Leggi tutto